Written by Charleston Bankruptcy Lawyer, Russell A. DeMott

Written by Charleston Bankruptcy Lawyer, Russell A. DeMott

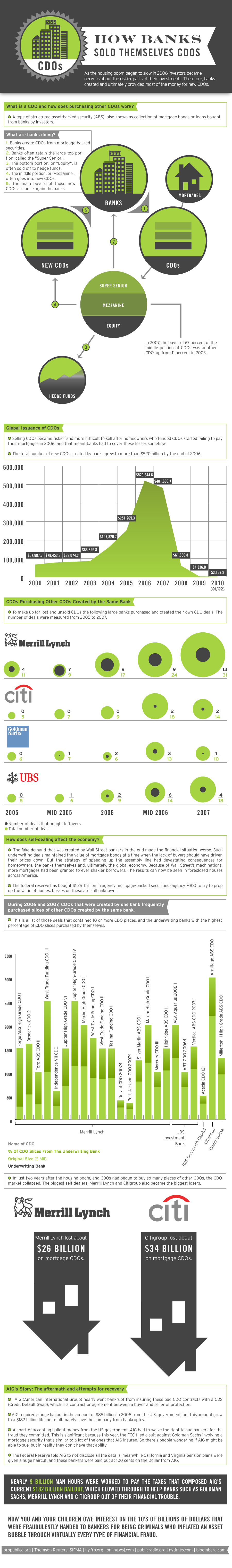

Here’s a chart I came across that illustrates the spread of collateralized debt obligations (CDOs for short). Basically, banks and other mortgage lenders sold these CDOs and Wall Street bought them without regard to the quality of the underlying obligations contained in these securities. Simply put, the lenders loaned money with reckless abandon because Wall Street would buy up the mortgages regardless of the fact that incomes, assets, and employment were frequently not verified. Nor did the quality of appraisals matter. Lenders didn’t care because they could sell anything to Wall Street. Wall Street didn’t care because the CDOs were being bought up and millions were being made by creating new securities. And then banks actually began buying CDOs. Go figure.

And the regulators slept. So now we’re up to our eyeballs in foreclosures.

Notice how there was an epidemic of activity from 2004-2007 during the height of the housing bubble. All this has led to bankruptcy at very high levels. This chart depicts what I try to explain to my clients as they explain how frustrated they are, how hard they’ve fought to avoid bankruptcy, and how bad they feel now that they have come to realize that bankruptcy is their 0nly remaining option.

As I explained to a bankruptcy client in Summerville last week, “plumbers didn’t cause this mess. Wall Street and big banks did.” Keep your perspective as you try to come to grips with your own financial situation.